ev charger tax credit california

Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. Currently the federal government offers a tax credit for both EV charger hardware and for installation costs.

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Funded by the California Energy Commission CEC and implemented by the Center for Sustainable Energy CSE the Southern California Incentive Project SCIP promotes access to electric vehicle EV charging infrastructure by offering rebates of up to 80000 for the purchase and installation of eligible public electric vehicle EV chargers in Los Angeles Orange.

. Look Up California EV Incentives By Zip Code. You might also qualify for up to a 7500 tax credit from the federal government. Get more info on the Electric Vehicle Federal Tax Credit.

And its retroactive so you can still apply for installs made as early as 2017. The maximum credit is 1000 per residential electric car charging station and 10000 for each public fueling station. Pasadena Water and Power customers can receive up to 1500 rebate for buyingleasing an EV and businesses can receive up to 50000 for installing public EV chargers Rancho Cucamonga Municipal Utility RCMU offers residents living in the service area a rebate up to 500 to install a Level 2 charger in their homes.

You need to owe 7500 in taxes to reduce and the California low. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations. The charging station must be purchased and installed.

The tax credit covers 30 of a companys costs. Listed incentives may not be available at any given time. Buy a home EV charger.

Purchasing an electric car can give you a tax credit starting at 2500. A tax credit is also available for 50 percent of the equipment costs for the purchase and installation of alternative fuel infrastructure. Dont Forget About The Federal Electric Vehicle Credit.

The US Federal Tax Credit gives individuals 30 off a Home Electric Vehicle charging station plus installation costs. Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year. We think ChargePoint Home Flex is a great choice because it charges up to 9X faster than a wall outlet adding up to 37 miles of Range Per Hour and is future-proof for your next car and home.

Current EV tax credits top out at 7500. Other tax credits are available if the battery size is 5kWh with a cap of 7500 credit if. This 2 million financing program provides incentives to small business owners and landlords to install electric vehicle charging stations for employees clients and tenants.

Department of Energys Federal and. Incentives are personalized for where you live. You may be eligible for a range of incentives including EV rebates EV tax credits and various other benefits.

That being said California is giving credits to EV owners for an electric car home charger. Heres how to claim your credit for 30 of the cost of your home charger and installation up to 1000. The credit attributable to depreciable property refueling property used for business or investment purposes is treated as a general business credit.

Realistically it would be hard to qualify both for the full federal 7500 credit which is a nonrefundable tax credit ie. Must be purchased and installed by December 31 2021 and claim the credit on your federal tax return. Use this form to figure your credit for alternative fuel vehicle refueling property you.

Just purchase or lease and apply with your taxes. Electric Vehicle Charging Credit SUMMARY The bill provides under the Personal Income Tax Law PITL and Corporation Tax Law CTL a 40 percent credit for costs paid or incurred to the owners or developers of multifamily residential or nonresidential buildings for the installation of electric vehicle. The credit is the smaller of 30 or 1000.

The federal tax credit was extended through December 31 2021. The credit varies depending on the vehicle make and battery size. Up to 7500 Back for Driving an EV.

Borrowers will need to contact a Participating Lending Institution to start the CalCAP loan enrollment process. The program is funded through the California Energy Commission. The federal government offers a tax credit for EV charger hardware and EV charger installation costs.

Well many EV owners are not aware of the benefits they can potentially rate for being an electric car owner. In the US the 2020 30C tax credit is good through the end of 2021. Companies can receive up to 30000 in federal tax credit for commercial installations.

It applies to installs dating back to January 1 2017 and has been extended through December 31 2021. Residents who buy qualifying residential fueling equipmentincluding electric vehicle charging stationsbefore the end of the calendar year might be eligible for a tax credit of up to 1000 see IRS Form 8911 for additional information. Listed incentives reflect an illustrative estimation of available incentives.

Residential installation can receive a credit of up to 1000. If your business has multiple locations you can. If youre considering installing an electric charging station in your home remember that the process will likely require obtaining.

Previously this federal tax credit expired on December 31 2017 but is now extended through December 31 2021. The federal 2020 30C tax credit is the largest incentive available to businesses for installing EV charging stations. For those that qualify Besides the generous credit for a LEVEL 2 home charger electric car owners can also qualify for a free HOV sticker.

It covers 30 of the cost for equipment and installation up to 30000. Information specific to your state can be found on the US. Get a federal tax credit of up to 7500 for purchasing an all-electric or plug-in hybrid vehicle.

Combined with the CA incentives your savings could be huge. The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. Pasadena Water and Power customers can receive a 600 rebate when they install a qualifying Wi-Fi enabled Level 2 240-volt electric vehicle EV charger or a 200 rebate when they install a standard Non Wi-Fi EV charger in their home.

So if you recently installed a home EV charging station or completed a large-scale EV infrastructure project you might still be eligible for this. It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs. Get the details on the credit available for the vehicle youre considering.

The tax credit is retroactive and you can apply for installations made from as far back as 2017. For example new EV purchasers may qualify for up to 750 in state tax credits in California in 2022 under the California Clean Fuel Reward program. Heres how you would qualify for the maximum credit.

.jpg)

Latest On Tesla Ev Tax Credit March 2022

How To Claim An Electric Vehicle Tax Credit Enel X

Study 1 In 5 California Ev Buyers Plan To Go Back To Gasoline Kelley Blue Book

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

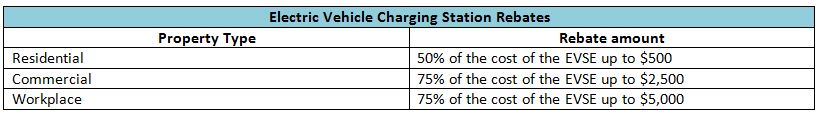

Charging Station Purchasing And Installation Rebate Programs For California

/cdn.vox-cdn.com/uploads/chorus_asset/file/22633236/1232464562.jpg)

The Fastest Way To Get More People To Buy Electric Vehicles Build More Charging Stations Vox

Solar Powered Ev Car Charging Manufacturer Receives 2 5 Million In Tax Credits Pv Magazine Usa

Rebates And Tax Credits For Electric Vehicle Charging Stations

/cloudfront-us-east-2.images.arcpublishing.com/reuters/43L4KKPDZFPS7AEGULKUZGRNT4.jpg)

Ustr Backs Efforts To Strengthen U S Ev Industry Despite Objections Reuters

Rebates And Tax Credits For Electric Vehicle Charging Stations

Rebates And Tax Credits For Electric Vehicle Charging Stations

Ev Drivers Are Unplugging Other Evs How Can A System Of Etiquette Arise

Tax Credit For Electric Vehicle Chargers Enel X

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

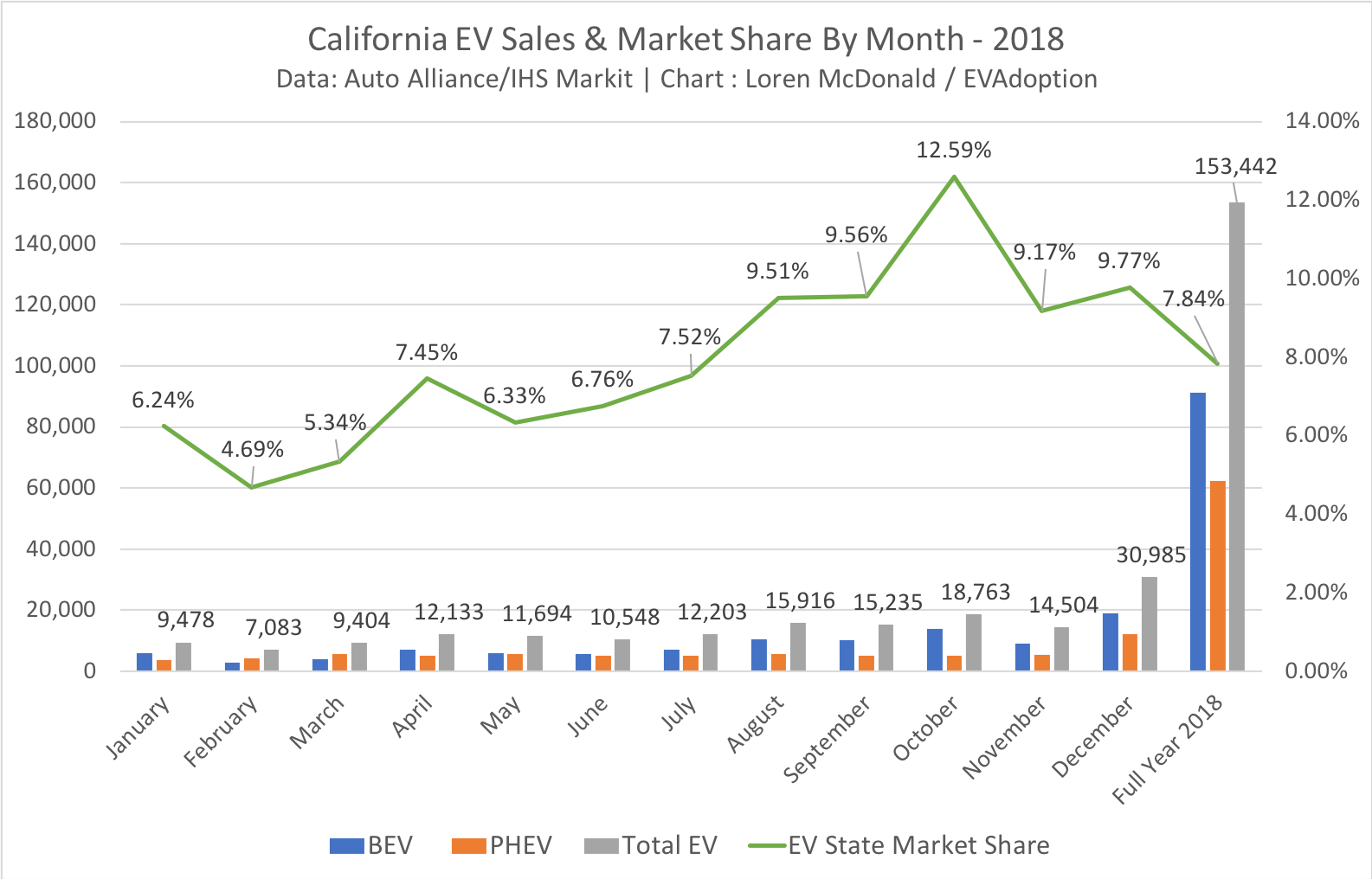

Ev Market Share California Evadoption

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Home Ev Charger Rebate Guide Chargepoint

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist